Get This Report on "ACH vs. Credit Card Payments: Which Is Better For Your Business?"

ACH Payment Processing: Everything You Need to have to Understand

ACH payment handling is a prominent procedure of creating electronic remittances in the United States. It stands for Automated Clearing House and is a body that enables the move of funds between bank profiles making use of electronic systems. In this blog post, we will cover everything you require to understand concerning ACH remittance handling.

What is ACH Payment Processing?

As discussed above, ACH settlement processing permits for the transactions of funds between financial institution profiles making use of digital networks. The process begins along with an consent from the account owner to allow for the move of funds. This permission may be given by means of a variety of stations such as on-line financial, phone or email.

Once certification has been gotten, the funds are transferred from one profile to another using an electronic network functioned by the Federal Reserve or private clearinghouses. The process normally takes 1-3 service times for funds to remove.

Why Use ACH Payment Processing?

There are many advantages to using ACH settlement handling over traditional procedures such as inspections or cord transactions. Some of these benefits consist of:

1. Pay With ACH -effective: Reviewed to cord transfers or paper checks, ACH payment processing is much more affordable as it includes lesser expenses per purchase.

2. Hassle-free: Since the majority of deals are conducted online, there is actually no necessity for physical checks or cash which creates it extra practical for each parties entailed in the purchase.

3. Safe: The use of file encryption and various other safety step makes certain that vulnerable information such as banking company account information remains safe and secure in the course of deals.

4. A lot faster than paper inspections: While it might take up to a week for a paper inspection to crystal clear, ACH transactions commonly take simply 1-3 service days which conserves time and quicken up money flow.

Types of ACH Repayments

There are actually two types of ACH payments - credit score and debit deals:

Credit Transactions: Credit rating transactions include transmitting loan coming from one account to another where the recipient's profile has received funds straight right into their account without any type of rebates. This is often made use of through organizations to pay out employees or suppliers.

Debit Transactions: Debit transactions involve transmitting cash coming from one profile to another where the recipient's profile has been debited for payment. This is frequently used by providers to collect repayments from customers.

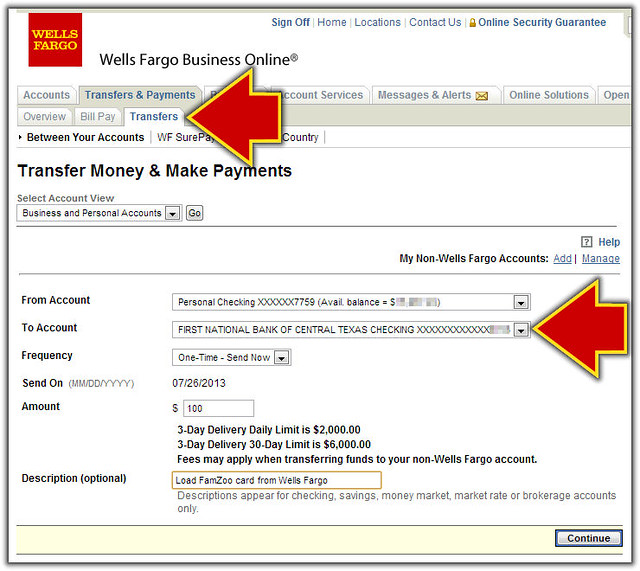

How to Prepared Up ACH Payment Processing

Specifying up ACH payment handling involves a handful of straightforward steps:

1. Get consent: The 1st measure is to acquire consent coming from the account holder to make it possible for for the transfer of funds.

2. Gather banking details: You will need to have to collect banking info such as path and account varieties from the account holder.

3. Decide on a payment processor: You can easily either choose a financial institution that uses ACH repayment handling or make use of a third-party remittance cpu.

4. Check your system: Create sure you examine your device prior to making any type of transactions to make sure everything is established up properly and working smoothly.

Verdict

In conclusion, ACH remittance handling is an dependable, cost-effective and secure technique of moving funds between banking company profiles in the United States. It provides many benefits over conventional strategies such as inspections or wire transmissions, including reduced expenses and faster purchase times. If you are considering utilizing ACH remittance handling, produce certain you know how it works and take the essential actions to prepared it up accurately so that you can take pleasure in its several advantages.